Published by Taylor Financial Group (for women)

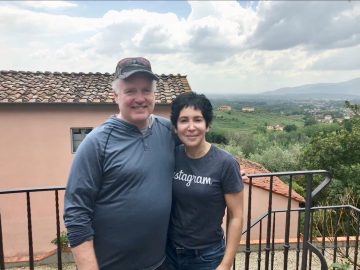

I just returned from celebrating my 21st wedding anniversary in Italy and I must say it was one of the most amazing times of my life! In between all the beautiful sites and delicious food, I spent time thinking about my marriage and how grateful I am for my husband and my family. Over the years, I’ve realized a successful marriage is a combination of many factors, such as reminding your partner how much you appreciate them, practicing honesty, and maintaining good communication. However, many married couples forget one of the most important things – being on the same page financially.

Here are some tips to help you start growing wealthy and happy together.

Make financial decisions together

In most marriages, there is typically one person that is more interested in the “finances.” Maybe you designate tasks such as paying bills to one person in the marriage who has the time and interest. However, you must establish a clear distinction between financial tasks and financial decisions. For example, it’s okay for your husband to prepare the taxes, but he shouldn’t decide whether to buy a new car without considering your opinion. You should be planning the big things that affect your family’s future together. Even if he’s the one earning the higher income in the household, that doesn’t automatically give him decision making power. Besides, it’s been proven that men and women have complementary financial skills that work better together, rather than separately. Team work makes the dream work! Plus, 90% of women will eventually be responsible for their families finances, so why not start now?

Watch the spending

Your weekly cleaning service, take-out food, and daily coffee runs may all be time and energy savers, but these expenses can start to add up. For example, a Starbucks latte every day can cost an extra $35 a week or $140 a month. That adds up to $1,680 a year! If your partner has an issue with how much you’re spending on some of these things, you should make the effort to reduce them – and vice versa. You can do little things, like make your own coffee at least four times a week, change the frequency of your cleaning service to bi-weekly, and limit take-out foods to the busy weekends. Likewise, if you have a problem with your partner’s spending, speak up so you can find common ground. Make use of our Cash Flow Worksheet to help you both keep track of what’s going in and out. After all, marriage is a combination of compromise and sacrifice.

Maintain individuality

You still need to maintain some independence. There is no need to justify every single expense. If you want that new $100 perfume and have the funds for it, then buy it! Just agree on a monthly amount that you and your partner will either put into separate accounts or take as an “allowance,” to be used however you please. Neither you or your partner should feel deprived.

It’s no secret that couples have different financial goals, and that’s okay. At Taylor Financial Group, we can help you align your goals so that you can focus on enjoying a happy marriage and look forward to a fulfilling future. Check out our Financial Future Planning Chart to see the services we offer that can make a difference in your life! And give us a call if you want to schedule an appointment.

Source:

Money.com, Just Married? Here are the Essential Tips to Know, May 2017

Securities offered through Cetera Advisor Networks LLC, Member FINRA/SIPC. Investment advisory services offered through CWM, LLC, an SEC Registered Investment Advisor. Cetera Advisor Networks LLC is under separate ownership from any other named entity.