The Week Ahead

Your Weekly News and Updates

January 19th, 2021

Dear Friends,

With global markets rallying on the hopes that massive economic stimulus will accompany President-elect Joe Biden’s new administration, Goldman Sachs’ projection that the S&P 500 will end 2021 at 4,300 points seems even more realistic.

Goldman sees the S&P 500 rising 14% through 2021, after the S&P 500 closed at 3,756 to finish 2020. A further 7% growth in the Index is projected for 2022 — reaching 4,600.

Underlying a double-digit forecast for returns in 2021 is the investment bank’s bullish projection on the U.S. economy — 6.4% real gross domestic product growth compared with the consensus of 4.2%. Adding to the economic boost for equities is an expected massive increase in earnings per share (EPS). Goldman expects EPS to shoot up 31% in 2021 after falling 17% in 2020. A large rebound from the dire impact the COVID-19 pandemic has had on corporate bottom lines.

What does this all add up to? Right now, a rosy economic outlook could add up to higher equity returns. But, no single trade will accomplish great returns. Our best ideas include emerging markets (primarily Asia), and including domestic value, cyclical and small caps. And, as we have stated several times during the last couple of weeks, core fixed income is challenged, and have actually posted losses year to date. With short and long term interest rates at a very low level, the degree of diversification you can expect from fixed income is low.

If anything, with high expectations for a stimulus package, inflation may start creeping up. Think not 60/40, but 50/30/20, with the 20% addressing multi- asset and alternative approaches (such as long/short, hedged equity, high yield, and so on). As always, feel free to reach out to us with any questions.

Source: https://www.marketwatch.com/story/goldman-sachs-says-the-s-p-500-will-rise-14-in-2021-heres-the-road-map-11610627051

IMPORTANT ANNOUNCEMENT FOR TFG CLIENTS: 1099 TAX FORMS

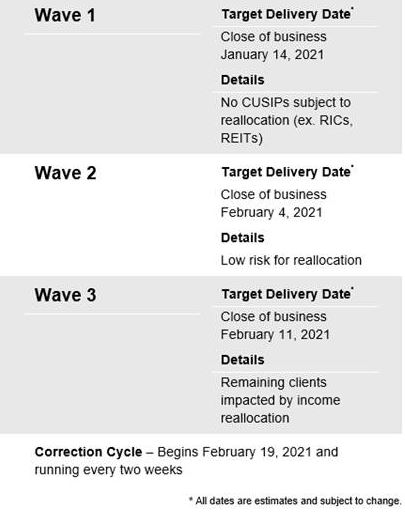

Ameritrade will be issuing 3 rounds of Form 1099s for 2020. Taylor Financial Group recommends that you NOT file your 2020 taxes until the 2nd correction cycle has been completed on March 5th.

Upon your request, TFG will securely email your 1099s to you and your tax professional or just to you, based on your preference. Please let us know.

Alternatively, if you would like to download the tax forms yourself, please see the step-by-step instructions below:

- Login to the Orion Connect Portal (LINK HERE: https://login.orionadvisor.com/login)

- Click the “Documents” tab on the top left of the page

- Click the “Tax Reports” tab on the left side of the page

- Navigate to “2020” and click to download a PDF of your tax forms

CURRENT STATE OF THE MARKET

Weekly Market Commentary 1.19.2021: Biden Proposes New Stimulus Package as Signs Point to Economic Slowdown

Published by The Carson Group, LLC

The signs of an economic slowdown continue. Initial jobless claims, which are released weekly, spiked to 965,000 last week. Claims increased by 181,000 and marked the highest weekly total since mid-August. Continuing claims increased 199,000, indicating those losing work are not finding new employment right away. Based on other data points, many of those filing for unemployment expect to be rehired when newly imposed restrictions are reduced…Read More

TFG: MONTHLY INVESTMENT UPDATE (NEW)

Three Themes to Watch In 2021

Written by Debra Taylor

In these ever-changing times, we wanted to update you on our assessment of the Investment Landscape as we begin 2021. Please see below 3 themes we are watching closely in early 2021…Read More

WHAT DOES A BLUE WAVE MEAN FOR YOUR INVESTMENTS? (NEW)

5 Charts on the Democratic Blue Wave

LPL Article Provided by Taylor Financial Group

One of the top questions we’ve received recently has been what a blue wave may mean for investments. After the Democrats won the two Senate runoff elections in Georgia, they will now control the White House and both chambers of Congress. Our January 11 Market Policy Projections for 2021 gave some of the immediate and longer-term policy impacts of the Democratic “blue wave,” and here we surf the blue wave with some interesting charts….Read More

UPCOMING WEBINARS YOU WON’T WANT TO MISS!

Six Things You Need to Know About The New Biden Administration How It Will Affect Your Wealth and Portfolio in 2021?

Client Only Webinar: Thursday, February 4th at 4:15 EST

“Open to All” Webinar: Thursday, February 11th at 4:15 pm EST

Here’s what you’ll learn:

- Major changes as a result of Biden’s election for your future portfolio

- How to position your portfolio to benefit in this current environment

- How you can protect your portfolio and your wealth from additional taxes

- Investments to consider under a Democratic Majority

- How to protect your wealth and your portfolio in 2021

Client Only February 4th REGISTER HERE!

“Open to All” February 11th Webinar REGISTER HERE!

COVID-19 HEALTH AND WELLNESS (NEW)

How vaccinated grandparents should approach visiting loved ones now — advice from Dr. Wen

CNN Article Provided by Taylor Financial Group, LLC

Many grandparents have one goal in mind this winter: Get vaccinated so they can see their children and grandchildren again. But is that safe if their younger family members have not yet been vaccinated? Older adults are one of the priority groups for vaccination. After health care workers and nursing home residents are vaccinated…Read More

MEDICARE UPDATE (NEW)

1) Yes, your Medicare Part B coverage WILL COVER your COVID-19 VACCINE 100%… Read More

2) Now’s the time for a Medicare Supplement Checkup. You can replace your Supplement at any time if you’re overpaying and in generally good health

- If you are overpaying and can pass underwriting (a health history lookback), you can often get the same great coverage at a lower premium by switching insurance companies.

- Make sure you do a Medicare Supplement Checkup every two to three years.

3) You can change your Medicare Advantage (MA) Plan from now through March 31, during the annual Medicare Advantage Open Enrollment Period (MA OEP)

· During the MA OEP, you can switch from your Medicare Advantage Plan to:

- another Medicare Advantage Plan, OR

- to Original Medicare with or without a prescription drug plan (Part D).

· You can make just one change during this period, to start the first of the following month.

4) You can sign up for Original Medicare Part A and/or Part B from now through March 31 if you missed your Medicare Initial Enrollment Period around your 65th birthday or when you left your employer’s health insurance.

- Enrolling during this annual General Enrollment Period (GEP), which runs from January 1 – March 31, means your coverage will start on July 1.

- Until that time, you will not be covered by Medicare.

- In addition, you may have to pay a Part B premium penalty for the months you’re without Medicare.

Have Medicare questions or want help? Book a no-charge Medicare check-in now with Nancy Schwartz, Medicare Coach & Licensed Independent Insurance Broker.

Nancy connects people like you with the right Medicare coverage at the best price. Her services are free to every client.

LAST WEEK WITH THE TFG TEAM…

Last week, Maximilian Taylor ran our “Open to all” Webinar!