Dear Friends,

“It’s tough to make predictions, especially about the future.” Yogi Berra

The starting point matters.

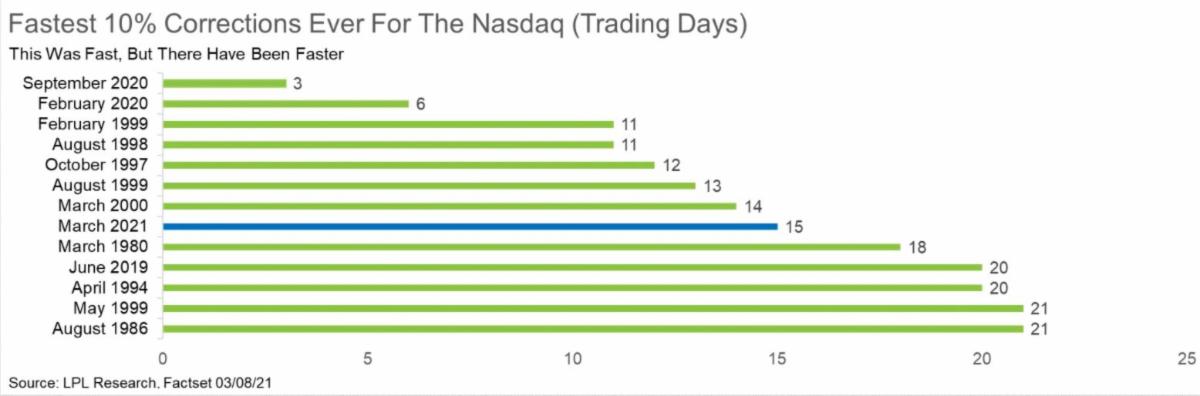

Early last week, the Nasdaq officially moved into correction territory, down more than 10% from the all-time high. It took only 15 trading days to do this, one of the fastest corrections ever. After reaching a 10% correction, the Nasdaq added 3.7% for its best day since right after the U.S Election in November 2020. Despite all the volatility, the Nasdaq was up over 3% last week. Talk about volatility!

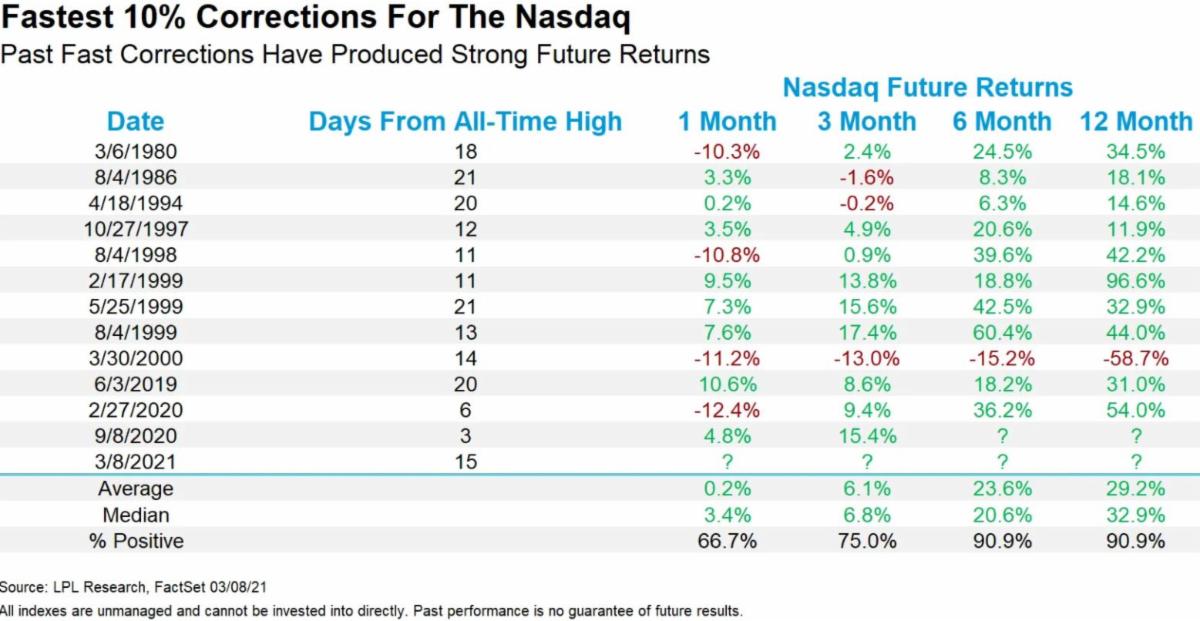

What does it mean? Well, as Yogi said before, predictions about the future are tough, but this recent volatility could end up having the bulls smiling. Yes, being down 10% in three weeks is a scary scenario for investors heavy in Nasdaq and technology names, but history might be on the bull’s side here. Looking at the previous fastest correction ever shows us that six months later the Nasdaq was up 23% on average and higher in 9 of the previous 11 times.

Why all the drama? Rates have been rising, but they are still historically low, with the 10- year Treasury yield at the end of February falling into the bottom 2% of all values dating back to 1962. While it’s true that rates become a bigger burden for businesses, consumers, and governments as they rise, even at current (and higher) levels, rates are still attractive and can continue to support a robust economic rebound.

And, as the chart below displays, previous fast corrections tend to resolve higher (or even much higher) going out 3 to 12-months.

This pullback no doubt feels uncomfortable and scary, but investors willing to use this correction as an opportunity to either “buy the dip” or to adjust their asset allocation (depending on your current positioning and your thesis) may very well be rewarded down the road. Remember to stay diversified, to take advantage of the reflation trade, and to buy high conviction companies, as it may help to alleviate any temporary discomfort that comes from volatility in certain sectors.

If you have any questions, please feel free to reach out to me.

Debbie