Dear Friends,

On August 16, the S&P 500 Index closed at 4480, 100% higher than the low on March 23, 2020. Hitting the 49th new high of the year, with full valuations and decelerating growth, many investors are asking “where do we go from here?” According to Goldman Sachs, the answer is probably up. A recent forecast released by Goldman Sachs predicts that the S&P 500 will return +7% by year-end 2021 (to 4,747) and approximately 12% over the next 12 months (to 4,969).

We heard similar questions in August 2020, when the market had rallied 50% to recoup its losses. Then again when it touched 60% in November. And again in January when it passed 70%, in April when it reached 80%, and in June when it hit 90%. But, according to Goldman Sachs the factors that have now brought the market to 100% – robust economic growth, improving corporate profitability, supportive policy, low rates, massive liquidity – are still in place today.

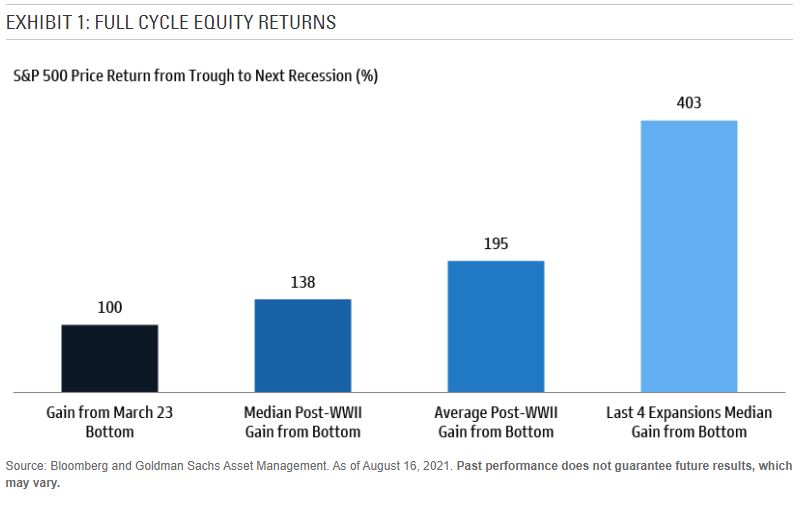

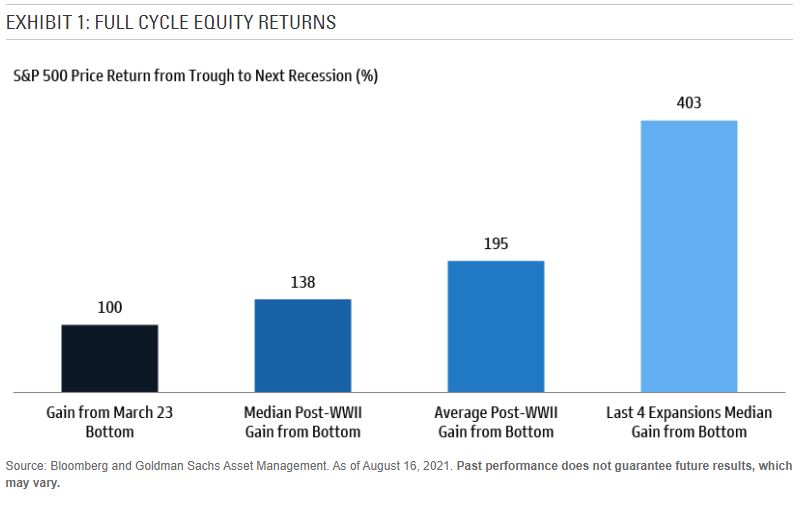

Historically, economic expansions have been good to equity markets. Almost 90% of the time, periods of US growth have led to positive 1-year returns. Over entire expansions, markets have regularly returned multi-fold returns. As Exhibit 1 below from Goldman Sachs illustrates, today’s 100% gain from the March 23, 2020 bottom has historical precedent to potentially move higher still.

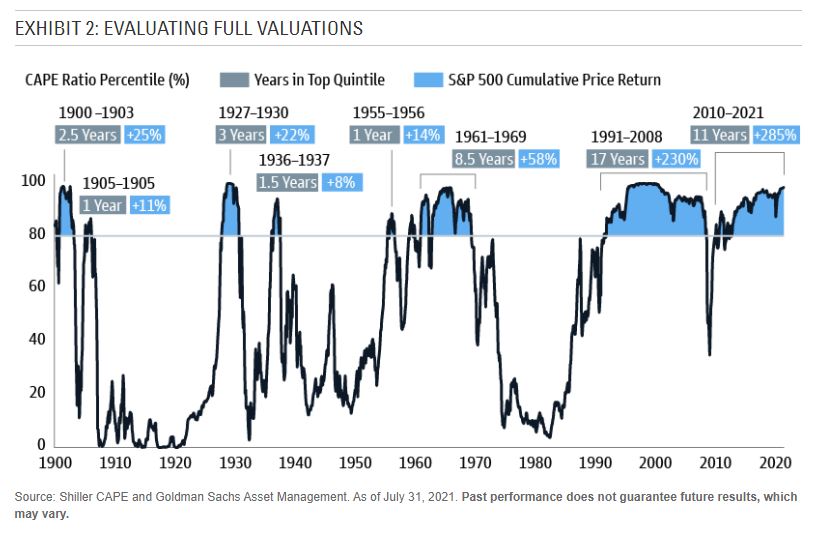

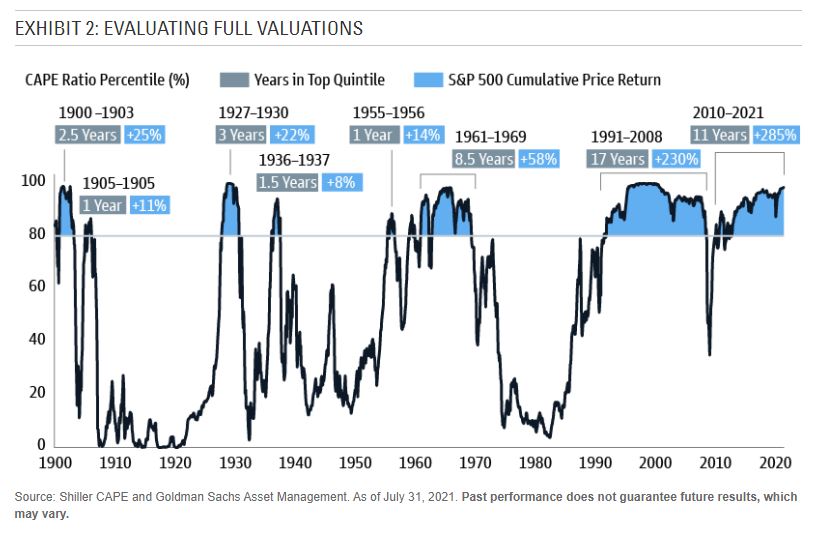

If investors are waiting for opportunities to buy at cheaper levels, the reality is that those moments are few and far between. Market valuations may appear lofty, but they have consistently held record valuations for most of the last three decades. As Exhibit 2 shows, full valuations have historically been sustainable in low inflation, low rate, high earnings environments. A lot of money would have been made being invested in this period, and a lot of money missed out by staying on the sidelines.

It is often quoted that the cardinal rule of investing is “buy low, sell high.” In reality, we are more often successful in buying high and selling higher. From the 100% rally so far this cycle, Goldman thinks the market can continue to 100+%.

If you have any questions please don’t hesitate to reach out.

Debbie