The battle of the bands that’s played all year—growth vs. value —could keep blasting away in April as investors ponder rising Treasury yields, a reopening economy, and a Fed that’s staying on the sidelines. It’s a bit of a tug-of-war.

While this rotation continues and bond markets assess the risk of inflation, we expect more volatility in equity markets, so diversification, not having too much concentration in any one sector or industry, will remain extremely important.

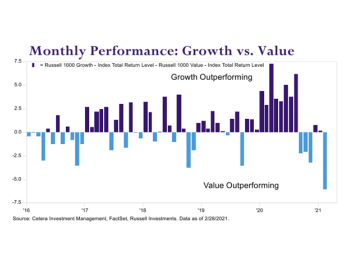

So far in 2021, value is having more fun after growth surged in 2020. Strong economic data, rising commodity prices, the relentless yield rally, and vaccination progress provided a nice boost for some of the big Industrial, Energy, and Financial stocks that stayed in the background last year while big Tech racked up the gains. As you can see from the chart below, the Russell 1000 Value has outperformed the Russell 1000 Growth Index by nearly 6%. The Value emergence we saw in Q4 2020 has lasted well into 2021The battle of the bands that’s played all year—growth vs. value —could keep blasting away in April as investors ponder rising Treasury yields, a reopening economy, and a Fed that’s staying on the sidelines. It’s a bit of a tug-of-war.

While this rotation continues and bond markets assess the risk of inflation, we expect more volatility in equity markets, so diversification, not having too much concentration in any one sector or industry, will remain extremely important.

So far in 2021, value is having more fun after growth surged in 2020. Strong economic data, rising commodity prices, the relentless yield rally, and vaccination progress provided a nice boost for some of the big Industrial, Energy, and Financial stocks that stayed in the background last year while big Tech racked up the gains. As you can see from the chart below, the Russell 1000 Value has outperformed the Russell 1000 Growth Index by nearly 6%. The Value emergence we saw in Q4 2020 has lasted well into 2021.

Consumer spending is already growing as people get vaccinated, but the real test likely comes starting in May when the government predicts anyone who wants a vaccine can get one.

Please reach out if you have any questions.

Debbie