By Dominique Vitalis, Senior Client Service Associate

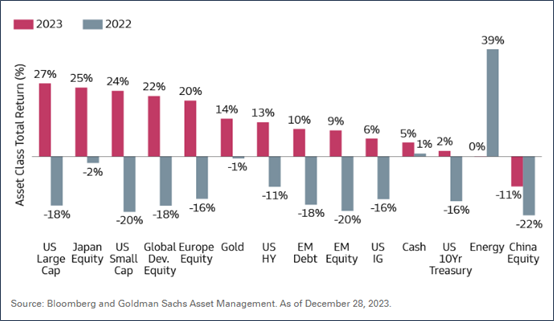

What a rebound in 2023 from the most unloved market ever! Market performance in 2023 marked a clear departure from 2022, with several asset classes performing significantly better than they did in 2022 and well above most expectations. In 2023, the S&P 500 was up +26.29%, the NASDAQ was up +44.64%, and the Bloomberg US Bond Aggregate was up +5.53%.

Big Tech largely fueled the S&P 500’s positive performance. However, without the “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta), the S&P 500 would have only been up +9% rather than +26%.

Big Tech has continued to perform in 2024, bolstering the S&P 500 and NASDAQ indices and helping drive the S&P 500 index to its latest all time high on March 1st. As of March 4th, the S&P 500 is up +6.66%, the NASDAQ is up +6.11%, and the Bloomberg US Bond Aggregate is down -1.44% year to date.

Looking forward into 2024, we remain cautiously bullish due to the recent run-up. We believe interest rates will stay higher for at least the first half of the year, somewhat impeding the market’s upward motion. Geopolitical events, such as the continued war in Ukraine and conflict between Israel and Gaza, further complicate the outlook. We still prefer large cap domestic equities, but we are hedging parts of portfolios. We are prepared for muted returns and volatility in 2024.

Brace for market volatility this year due to the presidential election on November 5th. Historically, irrespective of the short-term volatility, the stock market has performed well under both parties. Ultimately, we will continue to monitor reliable factors such as business fundamentals, economic statistics, and inflation data to inform our investment decisions and maintain a long-term perspective.

The Federal Reserve has signaled that it intends to begin cutting interest rates in 2024, however, the exact timing and number of interest rate cuts is unknown. Markets are now pricing in three interest rate cuts for 2024, down from a former consensus of six cuts seen back in December. Our house view is that the Fed will implement two or three interest rate cuts in later 2024 (barring some type of shock event). We continue to prefer shorter duration fixed income and credit in portfolios, but we are slowly gravitating towards longer duration and we are recommending against holding large amounts of cash as the market shifts towards lower rates.

For the long term, we continue to believe that equities provide among the strongest risk adjusted returns. We focus on quality companies with fortress balance sheets and predictable revenue growth (as rising interest rates have substantially increased the cost of capital). For 2024, we will continue to focus on fundamentals, and maintain our long-term focus.

Bloomberg U.S. Aggregate Bond – The Bloomberg US Agg Total Return Value Unhedged, also known as “Bloomberg U.S. Aggregate Bond Index” formerly known as the “Barclays Capital U.S. Aggregate Bond Index”, and prior to that, “Lehman Aggregate Bond Index,” is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate passthroughs),ABS and CMBS (agency and non-agency).

Nasdaq Composite – a stock market index that includes almost all stocks listed on the Nasdaq stock exchange.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.