Budgeting and Debt-Management Month

KICK THE NEW YEAR OFF RIGHT

A 2022 Guide to Key Dates for Retirees

Article Provided by Kiplinger

Deadlines are relentless, whether for tax filings, health plan open enrollments, or required distributions from retirement savings. The clock is always ticking, even in retirement, and the consequences for missing a financial deadline can be painful. This guide to key dates in 2022 serves as both a reminder…Read More

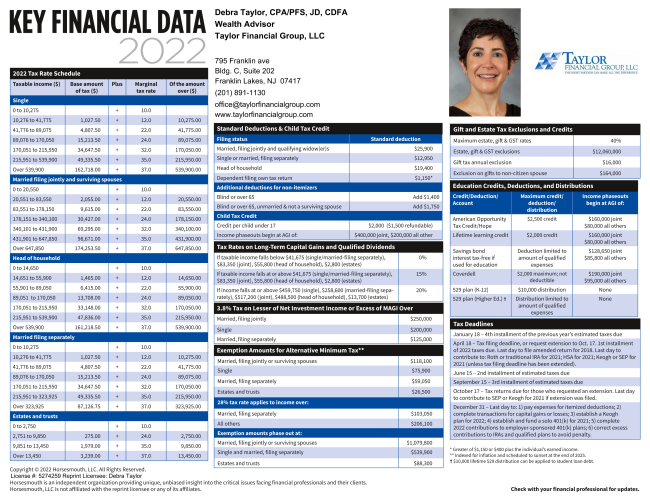

2022 Key Financial Data

Reference Card Provided by Horsesmouth

This very handy reference card helps you with your finances for the rest of the year. It’s called the 2022 Key Financial Data reference card, which offers fingertip access to all of the new numbers affecting taxes, health savings, Medicare, retirement, college planning, and more…Click Here to Download

TIPS FOR BUDGETING AND DEBT MANAGEMENT!

How to Build a Retirement Health Care Budget

Article Provided by Taylor Financial Group, LLC

Depending on how your life will change (or not) after retirement, you can base these projections on the amounts you currently spend. If you don’t plan to move, for example, your housing and utility costs will…Read More

Tackle Your Debt Before Retirement

Article Provided by Kiplinger

You should aim to leave the workforce with as little debt as possible. Otherwise, money that could be spent enjoying your golden years could end up going to repaying loans. You’ll need to decide if your debt is manageable. One gauge is your debt-to-income ratio…Read More

MISSED OUR CLIENT-ONLY WEBINAR?

A Look at the Year Ahead for 2022

Hosted January 6, 2022, at 4:15pm

Debra Taylor, Lead Wealth Advisor, spoke about current market trends, how your future planning may be impacted by new tax changes and how to help improve your wealth and investments in 2022 and beyond.

4. Ways to help improve your wealth in the upcoming months

Please click here to download the FULL Powerpoint presentation!

MISSED OUR LATEST ANNOUNCEMENTS?

Timing of Tax Year 2021 Consolidated Form 1099s

1.17.2022

We would like to keep you informed as to the estimated availability dates for the tax year 2021 tax forms. Given the information below, we recommend you provide 1099s to your accountants no earlier than the 2nd Correction Cycle, which is March 17, 2022…Read More

Required Minimum Distributions and Qualified Charitable Distributions

1.14.2022

When you reach age 72, the IRS instructs you to start making withdrawals from your Traditional IRA(s). These withdrawals are also called Required Minimum Distributions (RMDs). For some of you, 2022 may be the first year you…Read More