CURRENT STATE OF THE MARKET

Weekly Market Commentary 08.2.2021

Market Commentary: Supply Chain Issues Negatively Affected GDP and Housing in Q2, June

Published by The Carson Group, LLC

Supply chain issues continued to constrain economic growth and housing. U.S. GDP grew 6.5% in the second quarter, falling 2.0% short of expectations. Strong consumer demand created a surge in purchases. Production didn’t match demand, and the corresponding drop in inventories robbed more than 1% of GDP growth. Housing demand slowed as well last month. Shortages of appliances along with higher interest rates and prices are pressuring demand for housing…Read More

MARKET MINUTE WITH DEBRA TAYLOR: THE CHILD CARE TAX CREDIT AND WHAT IT MEANS TO YOUR FAMILY

On Monday, July 26th Debra Taylor spoke about the child care tax care credit update and what you need to know..Watch Now

AUGUST IS COLLEGE FUNDING MONTH

The FAFSA, which stands for the Free Application For Federal Student Aid, is the government application that millions and millions of parents fill out every year in order to qualify for federal and state college aid. The FAFSA gives families access to aid like federal parent and student loans and the Pell Grant, which is the major grant for middle- to lower-income families. There are also some minor grants from the federal government, for instance, for students who want to be a teacher in certain high-need subjects, or if a parent was killed in the Middle East conflict….Read More

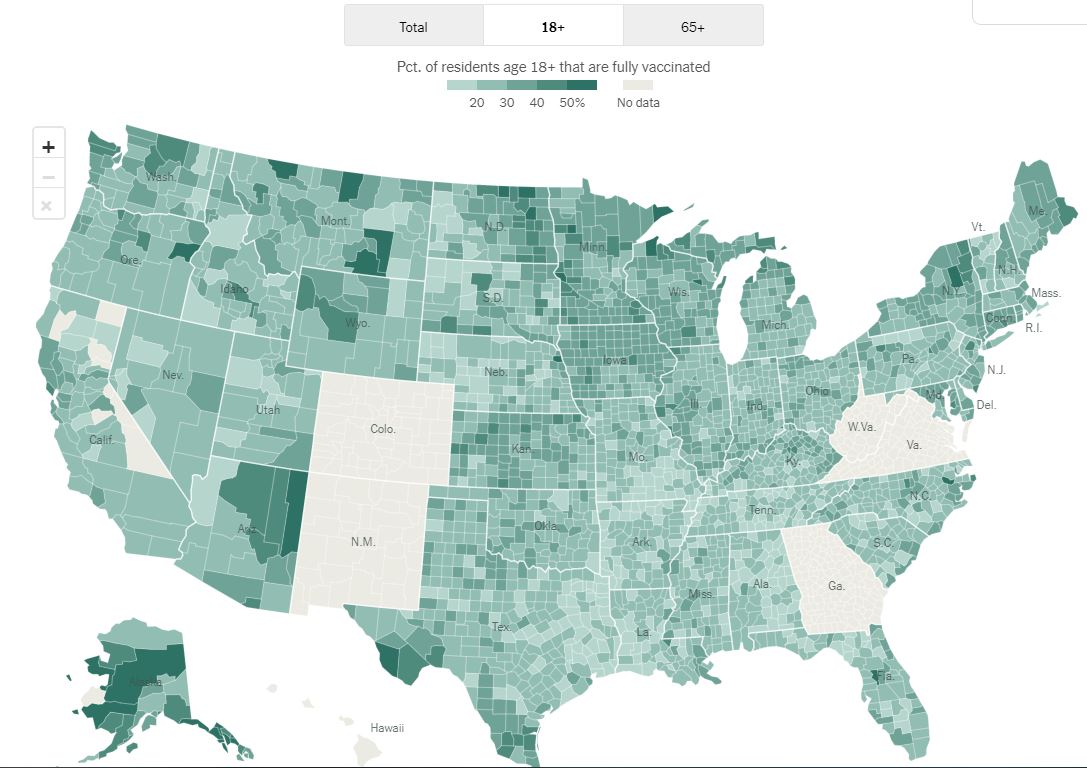

COVID-19 HEALTH AND WELLNESS

Vaccinated and Confused? Answers About Masks, the Delta Variant and Breakthrough Infections

The New York Times Article Provided by Taylor Financial Group