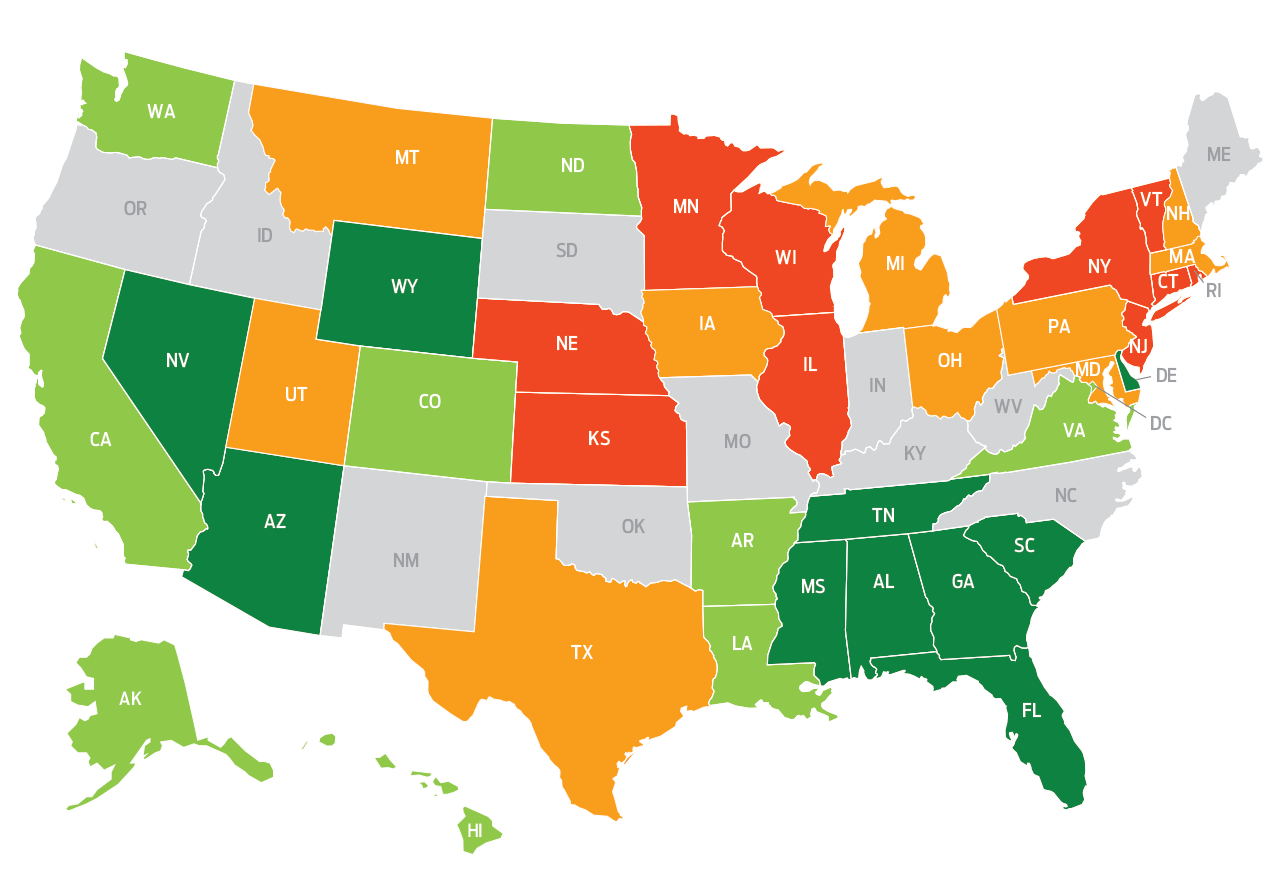

No two states are alike when it comes to taxes. They all have their own rules, rates and special tax breaks. As a result, your overall state and local tax burden in one state can be thousands of dollars more (or less) than in another.

What about your state? Are you in a high-tax state or a low-tax state (or somewhere in between)? That can be hard to determine. There are so many state and local taxes to worry about, and they’re constantly changing.

Last Week at the Office…

Last Friday, December 6th was “Sneaker Day” at TFG. It was a good choice for the day since we were (literally) running around preparing for the Holiday Party!

Stay updated with:

published by The Carson Group

Check out all this and more in The Week Ahead, Taylor Financial Group’s weekly newsletter.

Or, if you aren’t subscribed to receive our newsletter via email, sign up below in the webpage footer!

Have a question for Debbie about retirement planning in Ramsey, NJ?

Click here to schedule your complimentary phone consultation!