CURRENT STATE OF THE MARKET (NEW)

Weekly Market Commentary 07.19.2021

U.S. Stocks Struggle as Inflation Jumps; China’s Economy Continues to Rebound

Published by The Carson Group, LLC

Two big economic releases in the U.S. and a series of economic data in China highlighted a challenging week for U.S. stocks. Inflation surged 0.9% and has now increased 5.4% over the last year (Figure 1). The U.S. Consumer Price Index increased more than expected, led by large spikes in used vehicle prices…

Read MoreSUMMER VOLATILITY HEATING UP (NEW)

Summer Volatility Heating Up

Cetera Article provided by Taylor Financial Group

This summer and the second half of the year could be marked by more market volatility, as investors become less complacent about growing risks and momentum fades. Bond investors have been bidding up bond prices, sending 10-year Treasury yields lower, to under 1.3% (from 1.75% just a few months ago). This could be an ominous sign for the economy and equity investors are starting to take notice….

Read MoreSHOULD YOU BE CONCERNED ABOUT INFLATION (NEW)

Should You Be Concerned About Inflation?

Broadridge Resource provided by Taylor Financial Group

If you pay attention to financial news, you are probably seeing a lot of discussion about inflation, which has reared its head in the U.S. economy after being mostly dormant for the last decade. In May 2021, the Consumer Price Index for All Urban Consumers (CPI-U), often called headline inflation, rose at an annual rate of 5.0%, the highest 12-month increase since August 2008…

Read

JULY IS INVESTING AND PORTFOLIO MONTH (NEW)

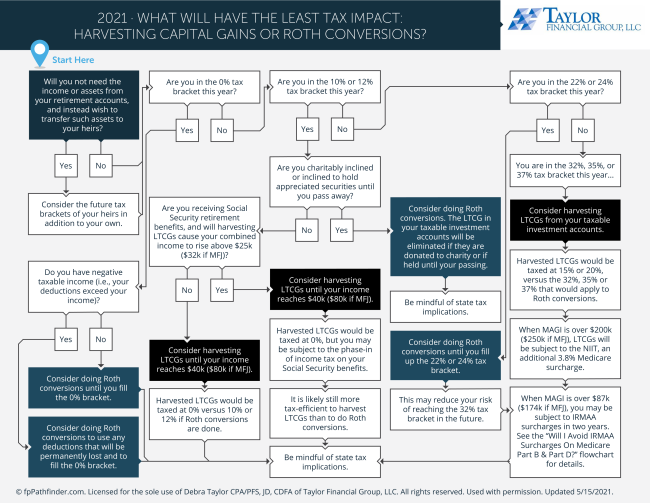

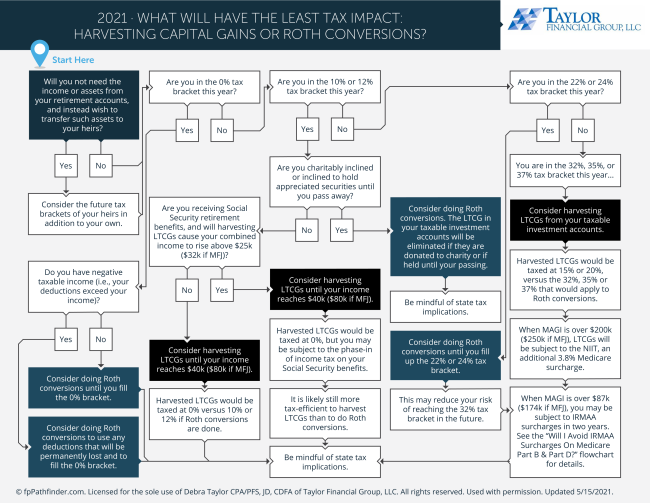

What Will Have The Least Tax Impact: Harvesting Capital Gains or Roth Conversions?

Checklist provided by Taylor Financial Group

You may often have outsized positions due to appreciation and large pre-tax retirement accounts. You may be looking to reduce portfolio risk and protect gains now, while also aiming to reduce your future income tax burden. Roth conversions and harvesting capital gains are two effective financial strategies that can achieve these goals; however, they accelerate income tax costs….

Read More

How Teens Can Start Investing Through a Roth IRA

Kiplingers Article provided by Taylor Financial Group, LLC

By beginning to invest in a Roth IRA at an early age, today’s teens can become tomorrow’s millionaires. A Roth IRA can be a great way for a child or grandchild to begin saving for retirement while learning about investing. A child can utilize a Roth IRA as long as he has some kind of income for the year. If the child isn’t a minor, he can open a Roth IRA at an investment firm….

Read More

GOLF CLINIC DAYS WITH TAYLOR FINANCIAL GROUP (NEW)

Each Golf Clinic is assigned on a first-come-first-serve basis so RSVP ASAP! And don’t forget Happy Hour (Or some extra holes after the clinic – up to you!)

Wednesday, August 4th, 8:45 – 9:45 am (Driving Range)

Wednesday, August 11th, 5:00 – 6:00 pm (Putting)

E-mail AnnMarie at

[email protected] to reserve your Wednesday Clinic Tee Time with Rob, Debbie, or the team!

COVID-19 HEALTH AND WELLNESS (NEW)

Covid-19 When Will Life Return To Normal?

Economist Video provided by Taylor Financial Group

Past pandemics have transformed societies—and this time it’s no different. As restrictions ease, glimpses of a pre-pandemic world have begun to reappear. Will life ever return to normal? To answer this question, The Economist has devised a “normalcy index” to track how behavior has changed, and continues to change, because of the coronavirus pandemic…

Watch HereCONNECT WITH OUR TAYLOR FINANCIAL GROUP PAGE!

Are you on Facebook?

Summer Volatility Heating Up

Summer Volatility Heating Up