One of the biggest risks facing any retirement income plan is sequence of returns. When you retire, you go from accumulation (saving for retirement needs) to decumulation (withdrawing from savings to meet retirement spending needs).

If you experience a down market early in the decumulation phase, it greatly increases the chances of you running out of money in retirement.

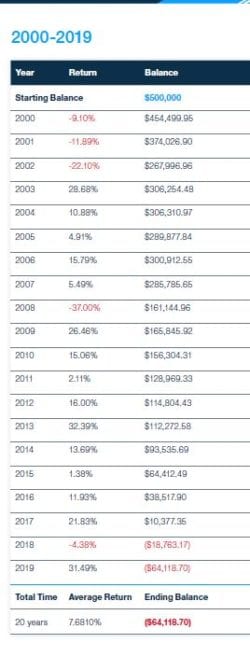

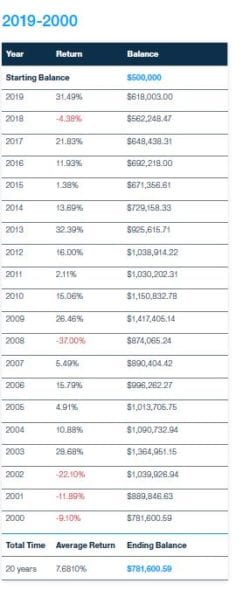

Look at the S&P 500 from 2000 through 2019, for example, which averaged a 7.681 percent positive return.

If someone would have retired in 2000 with $500,000 invested in the S&P 500 and they withdrew $30,000 every year (6 percent of the investment portfolio), they would run out of money in less than 20 years. However, if you invert the annual returns (so 2019’s return in 2000, 2018’s return in 2001, etc.), the account will have over $780,000 with the same amount of withdrawals! So despite having a 7.681 percent return, you couldn’t spend 6 percent a year with bad returns early. That’s the power of sequence of returns risk – and why you need to protect against a down market early in retirement.

Plan to Prevent Sequence of Return Risk

Don’t go into retirement alone. We can help you avoid the sequence of returns risk and many other risks associated with retirement income planning. Give us a call today!