Published by Taylor Financial Group

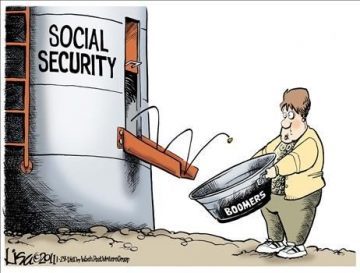

There has been a lot of news coming our way recently: Kim Kardashian met with President Trump to discuss prison reform, and, oh yeah, Social Security is expected to dip into its reserves this year. However, unlike the meeting that occurred between the President and a reality television star, we have been expecting Social Security’s program costs to surpass its income for years. We were only surprised by the fact that this initial deficit has occurred 3 years earlier than experts previously predicted. This is due, in part, to lower economic projections brought on by tax cuts, which results in less money available to fund the programs.

New projections cited in the Wall Street Journal predict that Social Security’s $3 trillion-dollar trust fund will run out for its retirement program earlier than previously predicted (in 2028 rather than 2034) when today’s 51-year-olds reach the normal retirement age and today’s youngest retirees turn 78. But, don’t panic! At the least, Social Security will be able to pay about 75% of the currently scheduled benefits due to incoming tax revenue.

There are possible solutions!

While this may all seem rather bleak, it is important to remember that there are two possible solutions to this problem. First, Congress really wants to keep their promise of Social Security and has debated ways to improve the finances surrounding the programs. Due to the importance of Social Security to voters, it is very unlikely that Social Security will not be available in the future (although we do anticipate means testing and other workarounds).

Second, to everyone who has not yet reached retirement age, remember that staying at your job just a year or so longer before retiring can drastically improve your retirement savings! The National Bureau of Economic Research found that working longer and delaying retirement and Social Security payouts by only three to six months has the same affect on retirement income as saving 1% of your salary a year for 30 years! Think about that. That means that if a 46-year-old high-wage worker wants to save more for retirement, it would be more beneficial for them to work an additional 29 months past the age of 66 than it would be to save an additional 10% of their salary for 20 years.

While this does not mean that you should forgo saving portions of your income to simply work longer instead, it is important to know just how powerful working longer can be to your retirement savings.

We will continue to monitor the situation in connection with Social Security and we will keep you posted. In the meantime, if you have any questions or want to discuss your retirement savings, give us a call.

Sources:

The Wall Street Journal, Social Security Expected to Dip into Its Reserves This Year, June 5 2018

ThinkAdvisor, Social Security Trust Fund on Track to Go Bust in 2034, June 6, 2018

The Wall Street Journal, Saving More for Retirement vs. Work Longer, March 26, 2018

Securities offered through Cetera Advisor Networks LLC, Member FINRA/SIPC. Investment advisory services offered through CWM, LLC, an SEC Registered Investment Advisor. Cetera Advisor Networks LLC is under separate ownership from any other named entity.