As a mother and wife, our Founder, Debbie Taylor, understands the struggles women face while working both in and out of the home. Debbie knows firsthand that raising children is an extremely important full-time job. Likewise, Debbie’s experience working as an entrepreneur and small business owner has allowed her to see the other side of the working woman, too. Because of her unique perspective as a mother and small business owner, Debbie fully understands how life can get overwhelming and how important things, like planning for your future, can get lost in the shuffle. In fact, for this reason, Debbie has spent the last 20+ years building her financial advising and wealth management business, so that she can help women just like you. Taylor Financial Group advises women from all walks of life, including women executives, small business owners, doctors, professionals and entrepreneurs. We are able to assist with stock option and executive compensation plans, pension analysis, and issues connected with running a small business or professional practice, such as setting up retirement plans.

Today, it is especially important for women to understand their wealth. Statistics show that 90% of women currently are or will at some point be managing their own money. Clearly, every woman should have a financial plan and a plan for her future. At Taylor Financial Group, we understand that every woman is different and has specific needs, which is why we are able to create personal plans to help you in whatever stage of life you are in. We can assist you in navigating your future in all areas, including retirement planning, investment planning, estate planning, and budgeting.

Let us help make your life less overwhelming. We are prepared to help you pursue your goals and live life to the fullest, while giving you financial confidence.

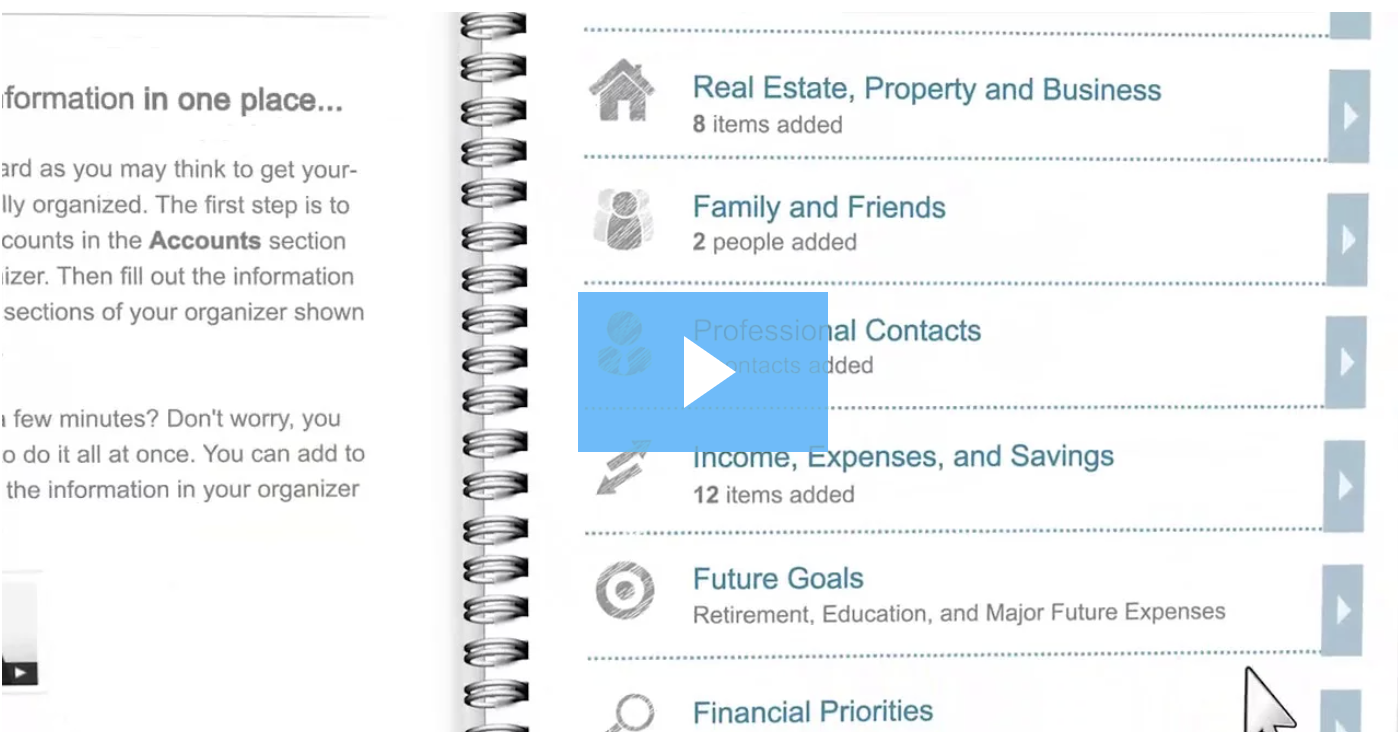

Watch this short video to see how we help career women manage their finances and take control of their future.

Sources:

Widows Are in Need of Financial Guidance Following the Loss of a Spouse, Sept. 30, 2013